IT incidents can have far-reaching consequences in any industry, leading to significant financial losses and reputational damage. A top-10 global bank with over 50 critical sites found itself grappling with high rates of IT incidents, with industry-impact incidents costing an average of $740,000 a year. To make matters worse, the bank’s lack of unified systems led to higher spending on reporting incidents rather than solving their root causes.

This case study examines how a global bank tackled this challenge with the help of MCIM by Fulcrum Collaborations.

The Challenge: Escalating IT Incidents and Inefficient Reporting

The global bank faced a daunting task: managing high rates of IT incidents across its numerous critical sites. Without a central system to track and analyze incidents, the response is reactive. More resources are used for reporting incidents rather than finding and fixing the root causes before failure. This inefficient process led to mounting financial losses and hindered the bank’s ability to mitigate risks proactively.

The Solution: Implementing MCIM for a Single Source of Truth

The bank implemented the full MCIM suite by Fulcrum Collaborations to overcome these challenges. MCIM provided a centralized platform that consolidated all critical asset information, creating a single source of truth. By seamlessly integrating data from various systems, MCIM empowered the bank to efficiently locate and identify problems, enabling a proactive approach to incident management.

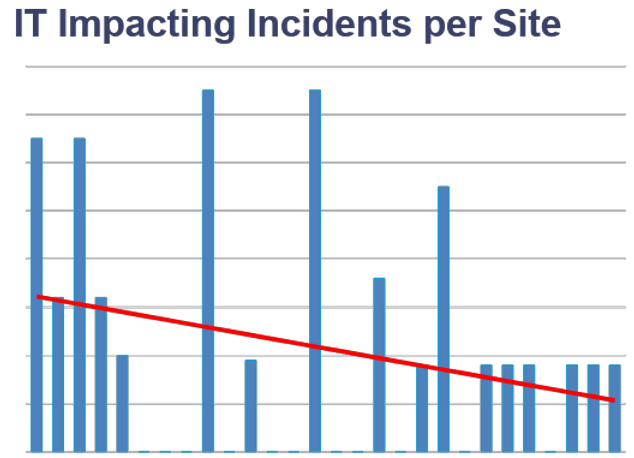

The Results: 70% Reduction in IT Impact Incidents and Millions in Savings

The impact of implementing MCIM was nothing short of remarkable. Within 18 months, the bank achieved a staggering 70% reduction in IT impact incidents. This significant decrease in incidents translated into more than $3 million in annual savings, demonstrating the tangible financial benefits of leveraging MCIM.

The bank used MCIM’s real-time analytics to determine why incidents were happening and develop specific solutions. The platform provided valuable insights, including:

- Real-time asset risk statistics across the bank’s entire portfolio

- Monthly uptime and granular root cause reporting to identify trends

- “Bright Spot” analysis of high and low-performing sites to drive process improvement

These features enabled the bank to proactively address potential issues, minimize downtime, and optimize its IT operations.

The Conclusion: Transforming IT Incident Management with MCIM

The top-10 global bank successfully used MCIM to show how a comprehensive critical asset management solution can make a big impact. MCIM helped the bank reduce IT impact incidents by 70% and save money through consolidating data, providing real-time analytics, and enabling proactive incident management.

By leveraging the capabilities of MCIM, organizations can gain a single source of truth for their critical assets, diagnose systemic issues, and implement targeted solutions to minimize incidents and safeguard their bottom line. Speak with an expert to find out more about how MCIM can help change your business.